BEIJING, Oct. 22 (Zhang Xu) Recently, "mutual insurance" has caught on fire, with more than 3.3 million fans in just three days, but many people may not really understand "mutual insurance".

Many netizens are curious, "Usually 1 cent, serious illness becomes 300,000?" So, what kind of insurance does mutual insurance belong to? What’s the difference with the mutual help platform on the Internet? Can you replace critical illness insurance?

What is "mutual insurance"?

Recently, Ant Insurance and Xinmei launched "mutual insurance" with each other: 0 yuan, an ant member (under 60 years old) with sesame score of 650 or above, joined, and paid a certain amount every month, and could enjoy 100,000 or 300,000 security funds covering 100 kinds of serious diseases.

"Mutual insurance" actually belongs to a kind of mutual insurance. At present, there are only three mutual insurance agencies in China, and Xinmei Mutual is one of them.

For most people in China, mutual insurance is a new thing. In fact, mutual insurance has a mature practice and wide application in the world, and it is not only used to protect serious illness.

"For example, in Japan, mutual insurance accounts for 80% of its insurance industry." Wang Xujin, director of the Insurance Research Center of Beijing Technology and Business University, told the reporter, "The biggest difference from joint-stock insurance is that the applicant and beneficiary are the same, which avoids moral hazard."

For example, joining "mutual insurance" means joining a mutual aid organization, sharing the expenses at ordinary times and getting protection when necessary.

After the insured person is diagnosed with the disease, he only needs to take photos with his mobile phone and upload relevant vouchers, and he can get the security money at one time without objection, with the amount of 100,000 or 300,000. If you don’t want to share it halfway, you can quit at any time, and you can join at any time after quitting.

Fang Yong, the person in charge of "mutual insurance" products, said that general insurance products will be priced according to the incidence of diseases, and users need to pay fixed premiums first. The user 0 yuan joins the "mutual insurance", and the subsequent expenses will be shared according to each payment case. If you have it, you will be exempted, and the threshold is very low.

To give a simple example, if 100 people join the "mutual insurance", one person is seriously ill, and the treatment fee exceeds 300,000 yuan, which will be shared among everyone, and everyone will have to pay 3,000 yuan each in the current period. If no one is sick, then there is no need to pay.

Will there be no limit to the monthly payment?

Although the threshold for 0 yuan’s participation in "mutual insurance" is very low, based on the principle mentioned above, some people are worried that there will be more and more money to be paid for subsequent sharing, and there is no upper limit.

In reality, the possibility of this situation is very low.

Ceng Zhuo, chief actuary of Xinmei Mutual, told the reporter that in fact, the probability of serious illness is not high. According to his estimation, the user’s share of expenses in the first year may be between 100-100 200 yuan.

As of the afternoon of the 19th, there were more than 3.3 million "mutual insurance" users. Some netizens are concerned that "mutual insurance" is shared according to the actual monthly claim amount. Can it cost less to join when 100 million people join the insurance?

In this regard, some people in the insurance industry told reporters: "Statistically, when there are enough samples, the ratio of the number of patients to the total number of participants will remain stable, so after the number of participants exceeds a certain number, the amount shared by each person will not change greatly."

Can mutual insurance replace the traditional critical illness insurance?

Some netizens said: The sharing price of "mutual insurance" is much lower than that of critical illness insurance. Can it replace critical illness insurance?

Yin Ming, president of Ant Financial Insurance Group, clearly replied that "mutual insurance" cannot replace the existing critical illness insurance.

First, the amount of "mutual insurance" is not high enough. The amount of protection under 39 is 300,000, and the amount of protection between 40 and 59 is 100,000. In reality, the medical cost of patients and families with major diseases is much higher than this amount.

The "2017 Claims Report" issued by Luen Thai Metropolitan Life Insurance Co., Ltd. shows that in 2017, the per capita compensation for major diseases was about 200,000 yuan. With the use of targeted therapy and other means, the cost of 400,000-500,000 yuan has become common.

Second, the guarantee period of "mutual insurance" is not long enough. "Mutual insurance" will automatically quit after the age of 60, and the data of "Experience Incidence Table of Major Diseases in China Life Insurance Industry (2006-2010)" shows that the incidence of major diseases is increasing with age. Mutual protection does not work when it is most needed.

Therefore, "mutual insurance" is more as an aid to critical illness insurance, which can benefit more groups lacking commercial health protection.

What’s the difference between it and a mutual help platform?

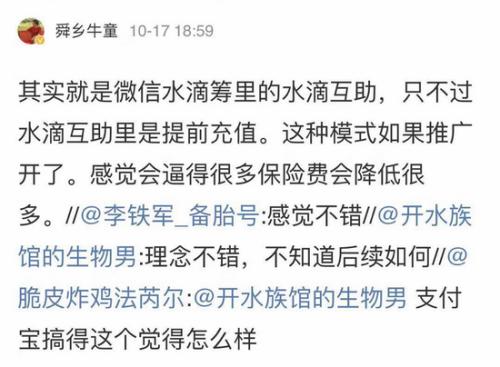

Helping each other is a prominent feature of mutual protection. There have been similar mutual aid platforms on the Internet before, such as "Water Drop Mutual Assistance" and "Quark Alliance".

However, there are fundamental differences between the two, and many online mutual aid platforms belong to mutual help communities. "And ‘ Mutual insurance ’ It is an insurance product that has been filed with China Banking and Insurance Regulatory Commission. " Ceng Zhuo said that "mutual insurance" is a one-time full rigid payment, which is also different from "how much you receive and how much you pay" for network mutual assistance.

Ceng Zhuo said that in addition to information disclosure in accordance with laws and regulations, "mutual insurance" also introduced two major measures: first, set up a publicity system and accept the supervision of all members; The second is to introduce blockchain technology to ensure that information cannot be tampered with. In addition, the personal information of the publicized person will also be kept strictly confidential.

In other words, "mutual insurance" is an insurance product with controllable risks, while "water drop mutual assistance" and "quark alliance" are not insurance and are not subject to financial supervision. (End)