Xinhuanet Beijing, December 27th (Reporter Lu Junyu) 2018 is the countdown, and in the coming year of 2019, a wave of heavy new regulations will be officially implemented.

Taxpayers will get greater tax cuts when the new tax law is implemented!

After several rounds of extensive consultation, on December 22nd, the State Council officially issued the Interim Measures for Special Additional Deduction of Individual Income Tax, which marked a key step for China’s individual tax reform to take comprehensive taxation, and taxpayers will receive greater tax reduction from next year.

The interim measures will be implemented on January 1, 2019 with the newly revised tax law. In the future, taxpayers can calculate the taxable income of individual tax, and besides the basic deduction of 5,000 yuan and special deductions such as "three insurances and one gold", they can also enjoy six special additional deductions such as children’s education, continuing education, serious illness medical care, housing loan interest or housing rent, and supporting the elderly.

E-commerce law governs online shopping chaos and treats online and offline fairly!

The E-commerce Law, which consists of seven chapters and 89 articles, provides detailed provisions on e-commerce operators, the conclusion and performance of e-commerce contracts, the settlement of e-commerce disputes, the promotion of e-commerce, and legal liabilities, and will come into force on January 1, 2019.

In order to protect consumers’ rights and respond to social hotspots, the E-commerce Law stipulates that for goods or services related to consumers’ lives and health, operators of e-commerce platforms fail to fulfill their obligation to review the qualifications of operators in the platform, or fail to fulfill their obligation to ensure safety for consumers, thus causing damage to consumers, they shall bear corresponding responsibilities according to law. If the operator of the e-commerce platform fails to take necessary measures against the behavior of the operator in the platform that infringes on the legitimate rights and interests of consumers, if the circumstances are serious, it shall be ordered to suspend business for rectification and be fined not less than 500,000 yuan but not more than 2 million yuan.

In recent years, mobile social media has become an important part of people’s daily life, and Wechat business has sprung up and developed rapidly. In view of this new situation, the e-commerce law has expanded the definition of e-commerce operators, and included Wechat business and live broadcast platforms in the supervision. And refine the joint liability of the e-commerce platform and the operators in the platform, and increase the review obligation of the e-commerce platform. Standardize e-commerce enterprises and platforms, and put an end to the phenomenon of "big data killing", "store bullying" and "barbaric growth".

The organic law of the "two houses" was overhauled for the first time in nearly 40 years, and the achievements of judicial reform were comprehensively confirmed and consolidated.

The Organic Law of the People’s Court and the Organic Law of the People’s Procuratorate came into effect on January 1, 2019. This is the first major overhaul of the Organic Law of the "two houses" in the past 40 years, which comprehensively confirmed and consolidated the achievements of the judicial system reform in recent years.

This revision has improved the organization and authority of courts and procuratorates. For example, according to the Law on the Organization of Courts, the Supreme People’s Court can set up circuit courts, intellectual property courts and financial courts, which are all important manifestations of judicial reform in court organization.

In terms of improving the effectiveness of legal supervision, the Organic Law of the People’s Procuratorate stipulates that the People’s Procuratorate may, according to the needs of procuratorial work, set up procuratorial offices in prisons, detention centers and other places, exercise part of the functions and powers of the people’s procuratorate that dispatched it, or conduct patrol inspections in the above places.

New version of birth certificate launched

According to the announcement of the National Health and Wellness Committee in official website, the medical certificate of birth will be revised soon. Since January 1, 2019, the medical certificate of birth (the sixth edition) issued by the National Health and Wellness Committee will be activated.

Social insurance premiums shall be uniformly collected by the tax authorities.

The "Reform Plan for the Collection and Management System of National Taxation and Local Taxation" clarifies that from January 1, 2019, various social insurance premiums such as basic old-age insurance premiums, basic medical insurance premiums, unemployment insurance premiums, work injury insurance premiums and maternity insurance premiums will be uniformly collected by the tax authorities.

This reform will have a series of important effects. Previously, five social insurances were collected by the social security handling department and the tax department in different regions, which was in a situation of "separate collection". After the introduction of this plan, they will be collected by the tax department in a unified way, thus improving the collection efforts and solving the once-existing problem of false fee base. Specific to the actual operation, the release of the "Reform Plan" means that the previous situation that some enterprises did not provide social security for their employees or did not provide full social security for their employees is expected to be changed, which is conducive to implementing the penalty for unpaid social security fees in Article 63 of the Social Insurance Law and standardizing the social security payment behavior of market participants.

China adjusts some import and export tariffs

From January 1, 2019, China will adjust the import and export tariffs of some commodities.

In order to actively expand imports, cut down the institutional costs of import links and help supply-side structural reform, China will impose provisional import tax rates on more than 700 commodities, including adding zero tariffs on miscellaneous meals and some raw materials for pharmaceutical production, appropriately reducing the provisional import tax rates on cotton sliding duties and some furs, canceling the provisional import tax rates on four solid wastes such as manganese slag, canceling the provisional import tax rates on thionyl chloride and lithium-ion batteries for new energy vehicles, and resuming the MFN tariff rate. We will continue to impose a lower provisional import tax rate on advanced equipment such as aero-engines and welding robots in automobile production lines, natural forage and natural uranium, which are urgently needed for domestic development.

In order to meet the needs of the reform of the export management system and promote the structural adjustment, quality improvement and efficiency improvement of the energy resources industry, since January 1, 2019, 94 commodities such as fertilizer, apatite, iron ore, slag, coal tar and wood pulp will no longer be subject to export tariffs.

China adjusts cross-border e-commerce retail import policy

From January 1, 2019, China will adjust the tax policy for cross-border e-commerce retail imports, raise the upper limit of commodity quotas enjoying preferential tax policies, and expand the scope of the list.

The adjustment of tax policy will increase the annual transaction limit from 20,000 yuan per person per year to 26,000 yuan, and the camera will be raised with the increase of residents’ income in the future. Raise the limit of a single transaction to 5,000 yuan, and make it clear that the duty-paid price exceeds the limit of a single transaction but is lower than the annual transaction limit, and only one commodity can be imported from the cross-border e-commerce retail channel, and the customs duties, import value-added tax and consumption tax are fully levied according to the goods tax rate, and the transaction amount is included in the total annual transaction amount. It is clear that cross-border e-commerce retail imported goods that have been purchased shall not enter the domestic market for re-sale.

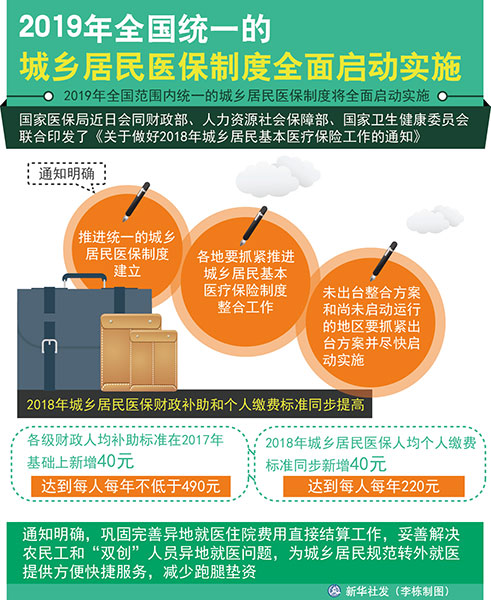

In 2019, the national unified medical insurance system for urban and rural residents was fully implemented.

It is understood that the National Medical Insurance Bureau recently jointly issued the Notice on Doing a Good Job in Basic Medical Insurance for Urban and Rural Residents in 2018 with the Ministry of Finance, the Ministry of Human Resources and Social Security and the National Health and Wellness Committee. The notice is clear and promotes the establishment of a unified medical insurance system for urban and rural residents. All localities should pay close attention to promoting the integration of the basic medical insurance system for urban and rural residents. Areas that have not introduced the integration plan and have not yet started operation should pay close attention to the introduction of the plan and start implementation as soon as possible.

According to the notice, in 2018, the financial subsidies for medical insurance for urban and rural residents and individual payment standards will increase simultaneously. 40 yuan will be added to the per capita subsidy standard of finance at all levels on the basis of 2017, reaching no less than 490 yuan per person per year. In 2018, 40 yuan will be added to the per capita personal payment standard of medical insurance for urban and rural residents, reaching 220 yuan per person per year.

The implementation of the Law on the Prevention and Control of Soil Pollution has made people feel at ease in eating and living.

The Law on Prevention and Control of Soil Pollution in People’s Republic of China (PRC) will be implemented on January 1, 2019, which is the first time that China has formulated a special law to regulate the prevention and control of soil pollution.

The law on the prevention and control of soil pollution consists of seven chapters and ninety-nine articles. The law clarifies that the prevention and control of soil pollution should adhere to the principles of prevention first, protection first, classified management, risk control, pollution responsibility and public participation.

According to the law, the state implements the list system of soil pollution risk control and remediation for construction land. The law stipulates the conditions, procedures, risk control and restoration measures to be taken for entering and leaving the land under the list management. If required by law, the land included in the list of soil pollution risk control and restoration of construction land shall not be used as residential, public management and public service land.

In addition, the law has formulated detailed punishment measures for illegal acts.

Implementation of the Regulations on the Administration of Administrative Divisions

The Regulations on the Administration of Administrative Divisions shall come into force on January 1, 2019. Administrative division is an important content for the party to lead the people to promote the modernization of the national governance system and governance capacity in accordance with the constitutional laws. On the basis of summarizing the implementation experience of the State Council’s Regulations on the Administration of Administrative Divisions for more than 30 years, the State Council formulated the Regulations. The promulgation and implementation of the "Regulations" is of great significance to the implementation of the major decision-making arrangements of the CPC Central Committee and the State Council on optimizing the setting of administrative divisions and strengthening the management of administrative divisions.

The official release of six national standards for electronic licenses has helped to realize the "one network management" nationwide.

The State Administration of Market Supervision, the National Standardization Administration Committee and the National Inter-Ministerial Joint Conference Office of Electronic Document Management (National Cryptography Administration) have recently officially released six national standards, namely, the overall technical framework of electronic license, the information specification of electronic license catalogue, the metadata specification of electronic license, the identification specification of electronic license, the technical requirements of electronic license documents and the interface specification of electronic license sharing service.

With the deepening of the reform of "Internet+Government Services", electronic license, as a professional and voucher electronic document with legal and administrative effects, has increasingly become the main electronic certificate for market participants and citizens’ activities, and is an important basic data to support the operation of government services. The formulation of national standards for issuing electronic licenses will provide standard support for the construction of national electronic license database and basic platform, the mutual recognition and sharing of electronic licenses across levels, departments and regions, and the integration and sharing of government information resources with licenses.

According to reports, the series of standards for electronic licenses issued this time stipulate the overall technical framework, unified license classification rules and basic information of electronic licenses, which will help promote the realization of "one network to run" nationwide, make the sharing of government information resources and services smoother, and make people feel that it is more convenient to do things. This series of standards will be implemented on January 1, 2019.