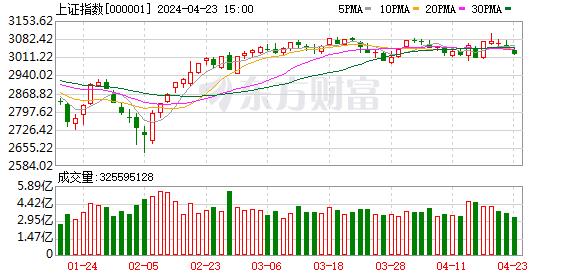

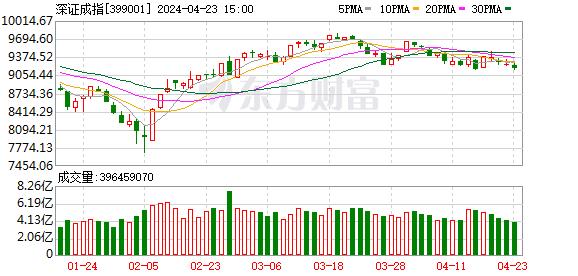

The three major indexes of A shares fell collectively,It fell by nearly 1.4%, and the net sales of northbound funds exceeded 4 billion. On the disk, the mining industry rose sharply, and Tongyuan Petroleum, Baken Energy, Bomaike, Zhongman Petroleum and Renzhi shares rose daily. The precious metals sector strengthened, Sichuan gold rose daily, and Zhongrun resources rose by more than 8%. Diet pills, oil, gas, jewelry, aerospace and other sectors are in the forefront of the increase list. Energy metals, semiconductors, Chiplet concepts, memory chips, PVDF concepts, batteries, fluorine chemicals and passive components performed poorly, leading the market down.

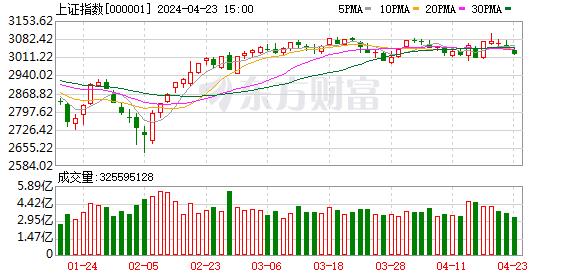

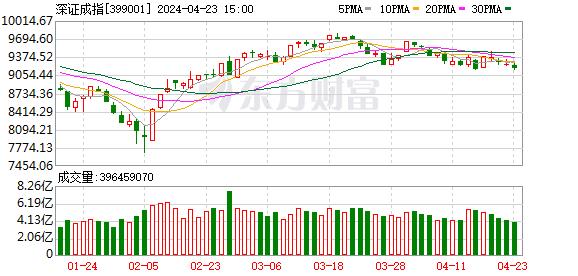

As of the close of noon,Down 0.40% to 3075.80 points; The Shenzhen Component Index fell 0.99% to 9968.99 points; Growth enterprise market index fell 1.37% to 1969.24 points; The Science and Technology 50 Index fell 1.49% to 878.47 points. The total turnover of the two cities in half a day was 525.2 billion, and the net sales of northbound funds was 4.415 billion.

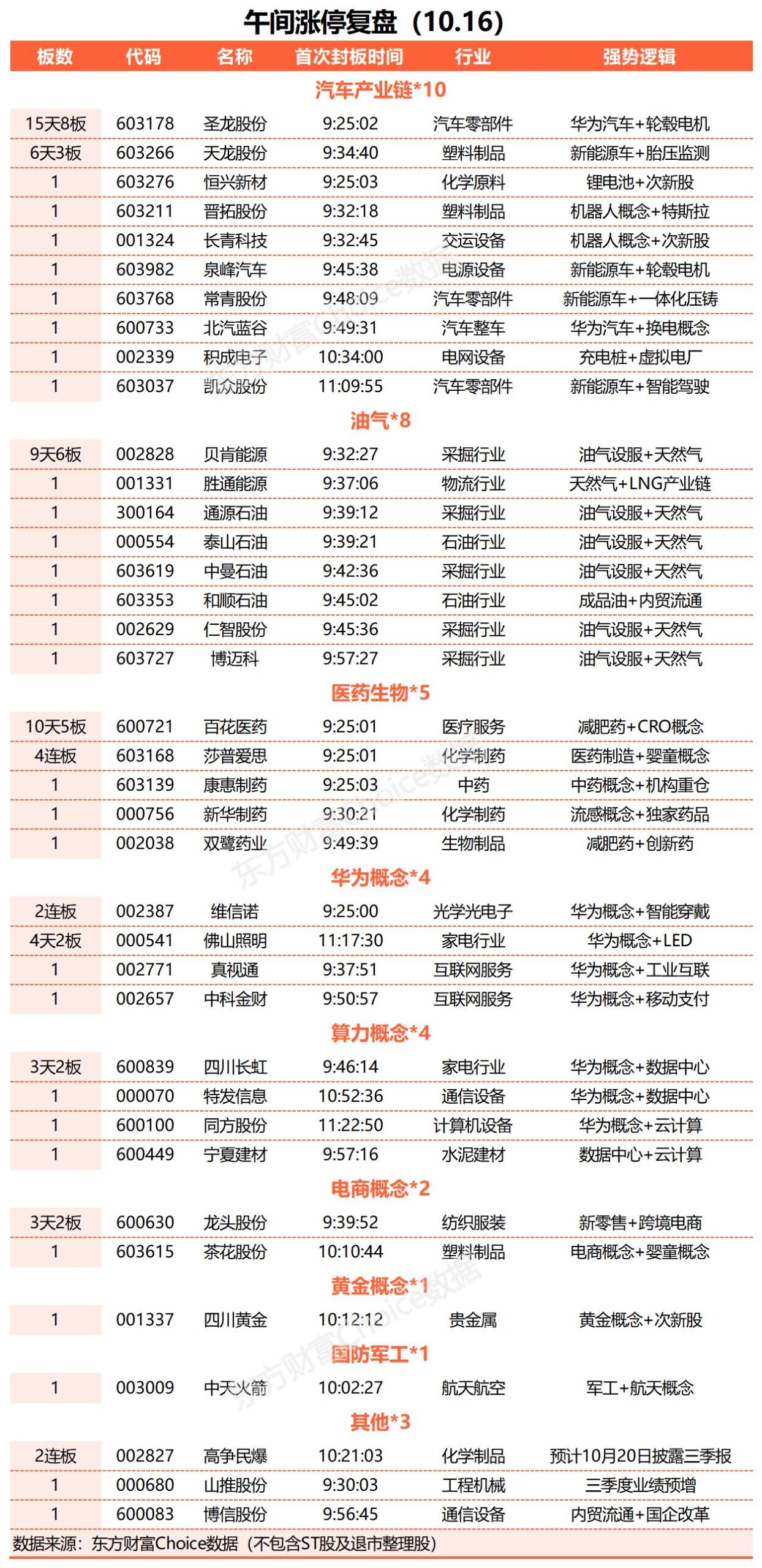

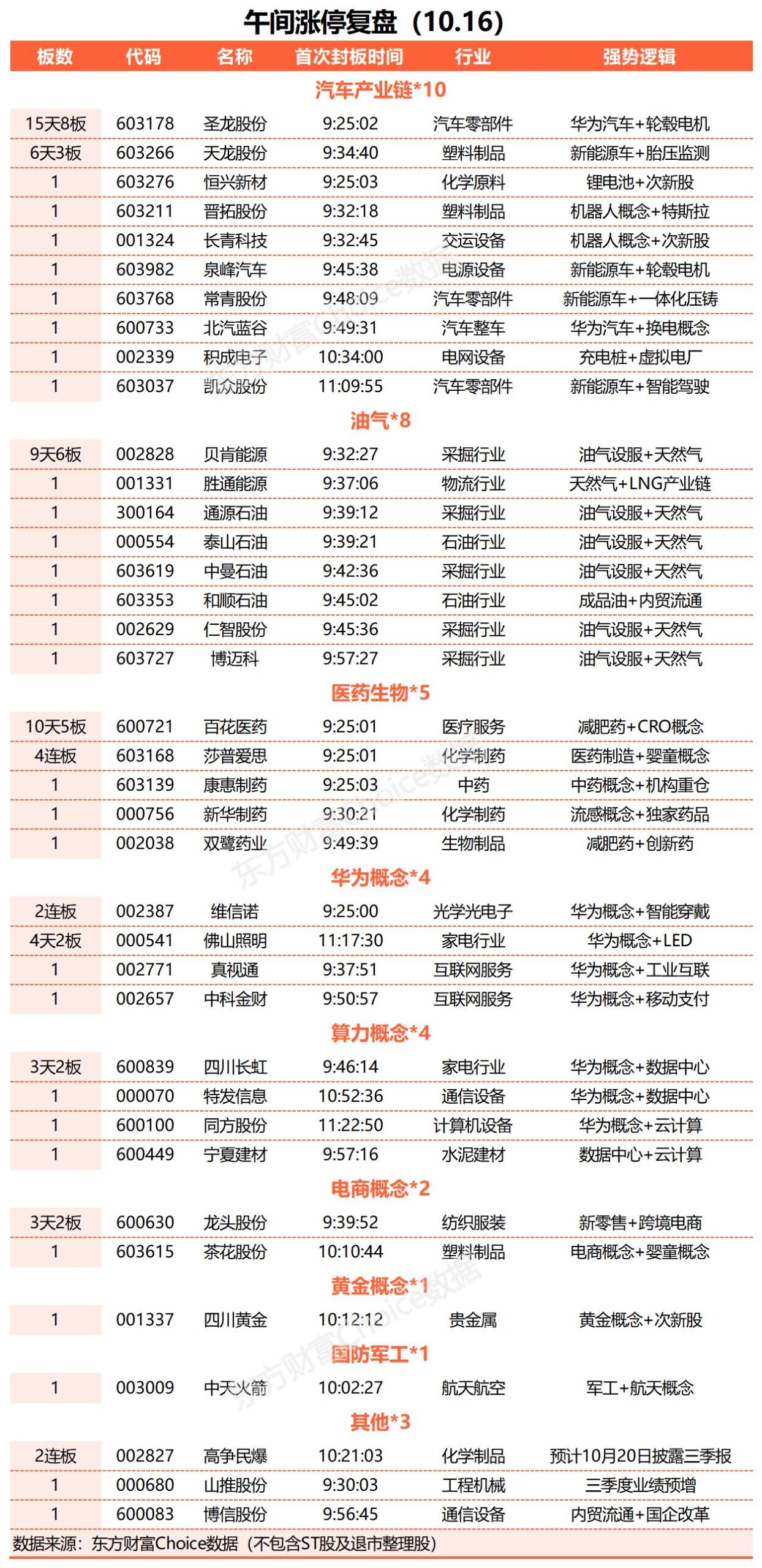

The closing rate of 45 shares is 67.16%.

In terms of daily limit stocks, as of noon closing, a total of 45 stocks had daily limit, and another 22 stocks once touched the daily limit, with a closing rate of 67.16%.

In terms of individual stocks, the auto sector has multiple daily limit, Shenglong shares have 15 days and 8 boards, and Jintuo shares and Beiqi Blue Valley have daily limit; Oil and gas stocks rose collectively, with daily limit of Tongyuan Oil, Beken Energy, Bomaike and Zhongman Oil. Gold stocks fluctuated and strengthened, and Sichuan gold rose daily; The concept stocks of diet pills continue to be active, and Baihua Medicine and Shuanglu Pharmaceutical have daily limit; The concept stocks of computing power fluctuated and rebounded, and Sichuan Changhong, Tongfang, and Tefa Information had daily limit; Military stocks changed in intraday trading, Morning Air rose more than 10%, and Zhongtian Rocket had a daily limit. In terms of decline, chip stocks collectively adjusted to make a good limit.

Northbound capital: net outflow of 4.415 billion yuan.

As of midday, there was a net outflow of northbound funds, of whichThe net outflow was 1.994 billion yuan, and the net outflow of Shenzhen Stock Connect was 2.421 billion yuan, totaling 4.415 billion yuan.

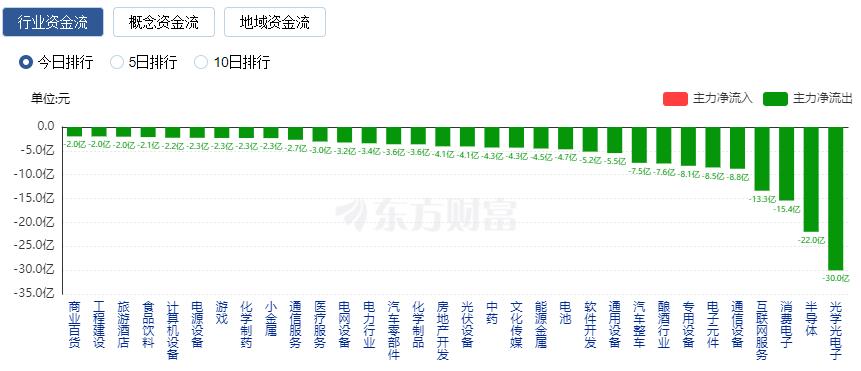

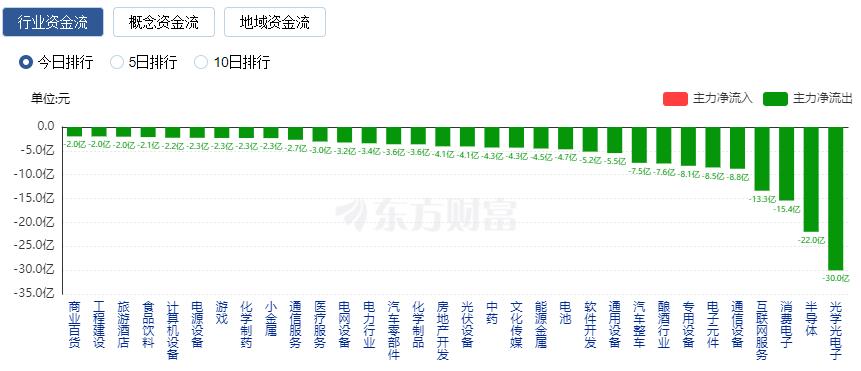

industryDirection: 370 million inflows of precious metals

In terms of industry funds, as of noon closing, precious metals, mining industries, etc.Ranked high, with a net inflow of precious metals of 370 million yuan.

In terms of net outflow, the net outflow of optical optoelectronics and semiconductors ranks high, of which the net outflow of optical optoelectronics is 3 billion yuan.

Transaction amount of individual stocks TOP10

In terms of the turnover of individual stocks, as of the close of noon, Cyrus ranked first in the two cities, with a turnover of 7.433 billion yuan; Shenzhen O-film Tech Co.,lt ranked second with a turnover of 6.678 billion yuan.

Today’s news

The adjustment and optimization of securities lending related systems is conducive to activating the market and boosting confidence.

On October 14th, the CSRC adjusted and optimized the system of securities lending and strategic investors’ lending of allotment shares, and tightened the securities lending and strategic investors’ lending of allotment shares in stages on the premise of keeping the system relatively stable. On the same day, the Shanghai and Shenzhen Stock Exchanges issued "On Optimizing Securities Margin Trading andThe notice on relevant arrangements for securities lending transactions further refines the relevant rules, and the increase in the margin ratio for securities lending will be implemented as of October 30, and other provisions will be implemented as of October 16. Tian Lihui, dean of the Institute of Financial Development of Nankai University, told the Securities Daily that the optimization of the securities lending system has increased the cost of securities lending, constrained the insider’s securities lending behavior, and demonstrated that the regulatory authorities are advancing with the times on the premise of respecting the market. Strengthen the responsibility and actions of "countercyclical adjustment".

The central bank continued to exceed 789 billion yuan, and the MLF interest rate remained stable.

The central bank launched a 7-day reversal of 106 billion yuanOperation and 789 billion yuan one-year MLF operation, won the bid.Both are flat, 1.8% and 2.5% respectively. Today, there are 240 billion yuan of reverse repurchase and 50 billion yuan of treasury cash deposits due.

40 billion! The securities industry today targeted "RRR cuts"!

China Securities Depository and Clearing Co., Ltd. will formally implement the arrangement of reducing the minimum settlement reserve for stock business on October 16, 2023. After the implementation, the proportion of reserve payment will be reduced from the original 16% to the expected target of 13% on average, which is nearly 40 billion yuan compared with the funds released in September.

Good news! ICBC, Agricultural Bank of China, Bank of China, China Construction Bank, Postal Savings Bank and Bank of Communications announced fee reduction and profit reduction.

In order to further guide the banking industry to support the development of the real economy and enhance people’s financial consumption experience, on October 12th, under the guidance of the regulatory authorities, China Banking Association issued the Proposal on Adjusting the Price of Some Banking Services to Improve the Quality and Efficiency of Services. Specifically, the fee reduction and profit-making projects involve bill handling fee, cost, personal deposit account statement printing fee, cost of security authentication tool, credit card transaction reminder, overpayment transfer fee, annual fee replenishment mechanism, repayment time and tolerance service mechanism, etc. As of October 13th, Industrial and Commercial Bank of China, Bank of China, China Construction Bank, Agricultural Bank of China, Bank of Communications, etc. have announced that they will actively respond to the initiative of China Banking Association, increase the efforts to reduce fees and make profits, and continuously optimize customers’ financial experience, but the specific implementation details and implementation time need to be announced later.

Pan Gongsheng, the governor of the central bank, recently voiced that monetary policy should continue to exert efforts and take advantage of the situation

Pan Gongsheng said that in the next step, China will pay more attention to the balance between economic growth and sustainability and actively promote high-quality and sustainable development on the basis of maintaining a reasonable growth rate. In terms of monetary policy, Pan Gongsheng said that China’s prudent monetary policy is precise and powerful, and it has intensified countercyclical adjustment, effectively responding to domestic and international risk challenges and consolidating the economic recovery. In the next step, we should continue to exert ourselves and take advantage of the situation, give full play to the dual functions of monetary policy tools, focus on expanding domestic demand, boost confidence, accelerate the virtuous circle of the economy, and provide stronger support for the real economy.

After the holiday, non-stop research on pharmaceutical stocks and diet pills has attracted special attention.

The attention of institutions to the pharmaceutical sector is increasing. In terms of funds, more than one pharmaceutical stock has boarded in the past week.Many institutions continue to increase their positions. ConggeFrom the point of view, some strategy chiefs once again listed the pharmaceutical sector as one of the key sectors in the fourth quarter. In addition, in just one week after the National Day holiday, many pharmaceutical companies have accepted dozens of well-known companies..

Public offering to play new music is tireless in order to enhance income.

Since this year, participationPublic offeringThe number of products reached 4,848, and the total amount allocated reached 46.056 billion yuan, of which 74% of equity funds in the whole market participated.. The market continues to fluctuate, and innovation is considered to be one of the important ways for Public Offering of Fund to obtain low-risk absolute returns. The data shows that dozens of small-scale funds this yearFor itContributed at least 2 percentage points of income.

The latest shareholding exposure of social security fund! Appeared in a number of A-share companies favor these stocks.

With the disclosure of the third quarterly report of listed companies in 2023,The fund’s position trend also shows the tip of the iceberg. The latest three quarterly reports that have been disclosed at present show that social security funds have appeared in the top ten of a-share listed companies in the third quarter of this year.Among them, companies with relatively stable operation and performance are generally favored.

Institutional point of view

Guosheng Securities: It is expected that the demand for home furnishing in the peak season of "Golden September and Silver 10" will continue.

Guosheng Securities Research Report pointed out that household consumption recovered during the 11th period, and the growth of Q4 leader is expected to accelerate. All home stores have started the "home rejuvenation consumption season" nationwide, and all regions have actively cooperated with the government to issue and undertake electronic coupons. We expect that the demand in the "Golden September and Silver 10" peak season will continue, and there is still room for improvement in the demand of first-and second-tier cities under the catalysis of policies, and the growth of home leading performance is expected to accelerate under the low Q4 base.

Guotai Junan: The siphon effect in the beauty industry is further enhanced.

Guotai Junan Research Report pointed out that the siphon effect of the beauty industry was significant in 2023, and it is expected that the growth rate of the Double Eleven will improve. Under the background of slow recovery of the consumption market, consumers tend to concentrate on buying when the big promotion discount is strong, so the siphon effect of the beauty market in 23 years has been further enhanced. Specifically, the growth rate of brands in Q1 and Q3 has dropped significantly in the off-season, but the head beauty companies in Q2 have made marginal improvements under the catalysis of 618. We expect that the beauty industry is expected to see an improvement in growth rate under the catalysis of the annual big promotion and double eleven.

Dongguan Securities: The pharmaceutical sector is at a relatively low valuation in the past decade, and the sentiment of the sector continues to pick up.

Dongguan Securities Research Report pointed out that the over-allocation rating of the pharmaceutical and biological industries should be maintained. The diet medicine industry chain has driven the plate sentiment to continue to pick up. In the sub-edition, GSK is the exclusive agent of Zhifei Bio.The heavy products of herpes zoster are good for stimulation, and the vaccine sector is among the top gainers this week. At present, the pharmaceutical sector is at a relatively low valuation in the past decade, and the sentiment of the sector continues to pick up. We can be moderately optimistic about the current position of the sector, and follow-up suggestions are to pay attention to structural opportunities such as diet pills industry chain, innovative drugs and medical services. The concerned sectors include medical equipment: Mindray Medical, UIH Medical and Australian-Chinese Endoscopy. Pharmaceutical business: Yifeng pharmacy, Dashenlin, Yinxintang. Medical beauty: Aimeike, Huadong Medicine, etc. Chinese medicine: China Resources Sanjiu, Tongrentang, Yiling Pharmaceutical; Innovative drugs: Hengrui Pharma, Huadong Medicine, etc.

Zheshang Securities: It is expected that monetary policy will continue to be loose.

Zheshang Securities Research Report pointed out that the total amount of credit was stable in September, but the resilience of the structure was relatively weak. We believe that China’s economy is still in a weak repair period, and credit data is still driven by "supply". Relevant policies are still needed to continue to pull "demand". As of September, we estimated that the excess savings balance of residents was 7.27 trillion yuan, an increase of about 93.7 billion yuan over the previous month, and continued to accumulate. In September, both the growth rates of M2 and M1 dropped, and the growth rate of M1 dropped to 2.1%, which means that the economic vitality still has room for repair. Generally speaking, we expect monetary policy to continue its loose tone, but the broad currency may converge and the focus will shift to broad credit. For large-scale assets, it is expected that China’s fundamental policies may be gradually strengthened, stocks attach importance to cyclical investment opportunities, and bonds remain volatile.

Ping An Securities: Structural warming characteristics are heating up.

Ping An Securities Research Report pointed out that A shares continued to consolidate last week, and the performance of electronics and automobile industries was relatively dominant, with obvious structural recovery characteristics. On the whole, although the short-term overseas risk disturbance still exists, the direction of marginal improvement of domestic economy and sustained efforts of policies has not changed, and the cost-effectiveness ratio of A-shares that have been adjusted to the relatively bottom area will gradually emerge in global risk assets. Structurally, it is suggested to continue to pay attention to the pro-cyclical dividend strategy, the pharmaceutical sector with a warmer market sentiment, the automobile sector with a rebound and transformation, and the TMT sector under the wave of technological trends.

CITIC Securities: Continue to pay attention to Huawei’s industrial chain and the "Kunpeng+Shengteng" ecology.

Citic Securities Research Report pointed out that overall, the global semiconductor boom has gradually bottomed out in Q2 this year. In September, the launch of Huawei+Apple’s new machine is expected to drive a new wave of rotating machines, and Q3 will start to consume electronics or enter the traditional peak season. The bottom of the memory chip cycle is clear, and DRAM/NAND welcomes the price increase; The performance of digital chips is divided, the downstream demand such as mobile phones and PCs is gradually recovering, and the demand related to AI is in an explosive growth stage; Analog chips are still waiting for the recovery of downstream demand, and the industry is under short-term pressure. Breakthroughs in core "stuck neck" links such as chips also boosted market confidence. In the short and medium term, it is suggested to continue to pay attention to Huawei’s industrial chain and the "Kunpeng+Shengteng" ecology. In the long run, the upstream high-end equipment, parts and materials will be the most direct beneficiaries of domestic alternative logic. Follow-up should continue to pay attention to Huawei’s shipments, chip yield, orders and further restrictions in the United States.

GF Securities: Social integration was acceptable in September, and it is expected to continue to be repaired this year.

GF Securities Research Report said that the current market pricing impact clues are more complicated and diversified; Objectively speaking, the social integration data in September is still relatively positive. Looking back, the total amount of social integration still has the kinetic energy to be further repaired during the year. First, the central bank’s meeting on August 18th explicitly demanded that "major financial institutions should take the initiative and increase the lending, and state-owned banks should continue to play a pillar role", which is obviously different from the "moderate total amount and steady pace" at the beginning of the year. Second, corporate bonds have a low negative feedback base in the bond market in the fourth quarter of last year; The third is the stock mortgage.After the adjustment, the early repayment behavior of residential departments may be reduced; Fourth, a new round of debt securitization may bring about some social integration increments. The social financing structure may also be optimized, and long-term loans in the enterprise sector may be affected by debt conversion, but the actual financing demand should not be too bad in the environment of profit recovery and centralized issuance of special bonds.

China CITIC Construction Investment Co., Ltd.: Huawei’s cross-border orders continue to exceed expectations, and related industrial chains are expected to benefit.

Citic Jiantou pointed out that the latest data of the Association showed that the wholesale sales volume of passenger cars in September was 2,451,700, +6.8% year-on-year and+9.6% quarter-on-quarter; Retail sales were 2,018,500 vehicles, up +5.0% year-on-year and+5.0% quarter-on-quarter; The wholesale of new energy passenger cars was 829,000, +23.0% year-on-year and +4.2% quarter-on-quarter, corresponding to the electrification penetration rate of 33.81%; On September 25-30, it retailed 128,600 vehicles, which was-5% year-on-year; Wholesale 153,500 vehicles, -6% year-on-year, and the wholesale end weakened slightly year-on-year. Recently, the new M7, Tucki G9, Zhiji LS6 and other models have been put on the market, and the price bands have dropped significantly. Among them, the new M7 car in the world of inquiry has a high degree of attention. On October 6th, the world of inquiry revealed that it had definitely exceeded 50,000 units, because its own products were strong and coincided with the high attention of Huawei’s mobile phone brand, and the M7 car in the world of inquiry spread in circles. The order of the intelligent driving version exceeded 60%, and the user’s cognition and acceptance of high-level intelligent driving was significantly improved. The automobile supply chain in Wenjie is improving its production capacity, and the parts with high value and high share are expected to benefit.

CICC: Focus on three main investment lines in combination with the results of the third quarterly report.

The research report of CICC believes that three main investment lines should be paid attention to in combination with the performance of the third quarterly report. As the profitability of listed companies is expected to improve marginally, compared with the first half of the year, it is suggested to increase the allocation weight in the fields of performance cashing and fundamental improvement. At present, high-growth areas are still relatively scarce, so it may be an important investment idea to grasp the fundamental inflection point and repair elasticity. In the stage of performance forecast and report disclosure of the third quarterly report, we should focus on: 1) the booming areas where the performance of the third quarterly report may exceed expectations or improve month on month. 2) The sub-sectors of scientific and technological growth that conform to new technologies and trends and have industrial catalysis, such as communications, semiconductors, consumer electronics, etc., which are expected to benefit from industrial autonomy and their own industrial prosperity improvement, and the pharmaceutical organisms that have been adjusted more in the early stage and have marginal mitigation expectations in industrial policies are also worthy of attention. 3) The improvement of demand, the improvement of supply pattern such as inventory and production capacity, and the areas with strong performance flexibility are worthy of attention, such as liquor, auto parts and upstream resource industries.

Donghai securities: All-vanadium flow battery meets the development opportunity

Donghai securities Research Report pointed out that the safety of energy storage power stations requires the development trend of superimposed long-term energy storage, and all-vanadium redox flow batteries meet the development opportunity. The high installed capacity of wind and solar energy has improved the demand of new power system for consumption, peak regulation and frequency modulation, superimposed with the implementation of relevant domestic storage policies, and the long-term trend of energy storage has become increasingly clear, and the long-term energy storage route such as all-vanadium redox flow battery has a good opportunity for development. At present, the life cycle cost of vanadium battery is better than that of lithium battery and sodium battery. Marginal cost decreases with the length of energy storage, and the cost advantage is prominent in the long-term energy storage market. In addition, the construction period of vanadium battery is short, the floor space is small, the site selection is not limited by natural resources, and it can flexibly adapt to all sides of the source grid load and has stronger adaptability to wind and solar installations. At present, the industrial chain of vanadium batteries has basically formed, and the market demand needs to be released urgently.

Hua Fu Securities: The quarter-on-quarter improvement of some tracks in the chemical industry is worth looking forward to

Hua Fu Securities Research Report pointed out that the third quarterly report was disclosed in October, and the quarter-on-quarter improvement of some tracks in the chemical industry is worth looking forward to. Looking to the future, it is necessary to actively grasp the profit release and high profit under the background of high prosperity of traditional energy (coal-crude oil)The high dividend effect brought by low valuation, while actively tracking the changes in the sub-track. It is suggested to pay attention to: 1) energy security: China’s special estimate, abundant cash flow & stable dividends; 2) Middle and lower reaches: refining and chemical industry, tires, chemical fiber, fluorine chemical industry, coal chemical industry, agrochemical products (leading compound fertilizer), membrane materials, real estate infrastructure materials (alkali, titanium dioxide, silicone rubber, paint, etc.), modified plastics, dyes, civil explosives and surfactants; (3) New materials: high-end polyolefins and catalysts, aerogels, high-end carbon black, OLED luminescent layer materials, semiconductor and lithium battery materials, aviation and special ship materials, sweeteners and bio-based materials.

Orient securities: The medical demand is rigid, and the long-term trend of the industry is improving.

Orient securities Research Report pointed out that in the long run, medical insurance fee control and normalized centralized purchasing will continue, and enterprises need to choose new varieties and fully grasp the clinical needs. Therefore, we are optimistic about enterprises with real innovation ability, and suggest focusing on the demand opportunities at the product end. In terms of medical devices, the conventional diagnosis and treatment continues to resume the marginal relaxation of the superposition policy, and the plate is expected to usher in Davis’ double click. It is recommended to pay attention to Mindray Medical, Sanyou Medical and Bairen Medical. In terms of innovative drugs, research and development continue to be promoted under strict review, and attention should be paid to cutting-edge clinical progress. It is suggested to pay attention to Hengrui Pharma, Jingxin Pharmaceutical and Kangchen Pharmaceutical. In terms of CXO, the industry prosperity is expected to improve marginally, which has the bottom investment value. It is suggested to pay attention to Sunshine Nuohe, Wuxi PharmaTech and Kanglong Chenghua.

Open source securities: coal prices fluctuated at a high level, and stable performance and high dividends made the valuation cost-effective prominent.

The open source securities research report pointed out that we maintain the logical recommendation of high winning rate and high margin of safety for the coal sector, and both offensive and defensive: from the perspective of high winning rate, high dividends have gradually been favored by capital market funds, and high dividends for coal enterprises have become a major trend; At present, the steady growth policy is introduced and exceeds expectations, and coal stocks will also become offensive varieties. As an upstream resource link, it will inevitably be boosted by downstream demand, reflecting the price increase. In terms of safety, we believe that the valuation of coal stocks has been at the bottom of history, PE valuation is 5-6 times of the performance in 2023, and the PB-ROE method is used to analyze that coal stocks have a high ROE, but Pb is greatly discounted, and the value of coal enterprises is underestimated. Beneficial targets with high flexibility, high dividends and growth: mountain coal international, Yankuang Energy and Shanxi Coking Coal; Beneficial targets of steady and high dividends: China Shenhua and Shaanxi Coal Industry.

Guohai Securities: Adhere to AIGC Main Line+Cinema Line+Low Valuation Main Line.

Guohai Securities Research Report pointed out that there was a temporary adjustment in September due to the poor box office performance caused by the empty window of supply and the expected landing of the interim report. The economic recovery is superimposed on the emotional recovery of watching movies, optimistic about the performance elasticity of the film and television sector; The normal distribution of the game sector and the new product cycle are expected to release profits. At the present stage, we are still optimistic about the application of AIGC in the media industry. Media companies have the advantages of users, scenarios and data. In the future, cooperation with large model manufacturers is expected to improve content production efficiency, enhance experience, accelerate industry innovation, and continue to pay attention to the application development of games, IP, marketing, e-commerce, education, film and television. At present, we adhere to the strategy of AIGC mainline+cinema line+low valuation leading stock selection. We believe that AIGC is expected to bring a new round of content productivity revolution.

Shanxi securities: optimistic about the performance of gold and jewelry enterprises in the third quarterly report

Shanxi Securities Research Report pointed out that from the report point of view, we continue to be optimistic about the performance of gold and jewelry enterprises in the third quarterly report, driven by the Qixi Festival in August and the franchisees actively stocking in September. From the perspective of follow-up demand, after a short-term rapid decline, gold prices have started to rebound, and both international gold prices and domestic gold prices have rebounded. Continue to be optimistic about the relative prosperity of the gold and jewelry industry in optional consumption. In the medium and long term, we are still optimistic that the progress of gold technology will continue to stimulate young consumers to satisfy their needs. It is suggested to pay active attention to Zhou Dasheng, Lao Fengxiang and Chao Hongji.

Central china securities: Pay attention to the film and television, games and advertising sectors with rising prosperity.

Central china securities Research Report pointed out that the overall performance of the media sector rebounded in the first half of the year, and the fundamentals showed an improvement trend. Although some sub-sectors once experienced short-term performance pressure, there is a greater possibility of improvement in the future. Q2′ s film, television, advertising and book sales have been well restored. At the same time, since the end of Q2, the market scale of film, television, advertising and games has improved, and the demand for cultural consumption and advertising has rebounded, which is expected to support the performance of Q3′ s media sector and continue into Q4. In the medium and long term, we will continue to pay attention to the new changes brought by AIGC technology to the industry, including the changes of content production mode, the innovation of commercial realization mode, the revaluation of industrial chain value and the changes of competition pattern. It is suggested to pay attention to the film and television, games, advertising and publishing sectors with strong defensive attributes, and pay attention to the performance of key companies in the third quarter recently disclosed.

China Post Securities: The short-term A-share environment is intertwined and will continue to fluctuate and grind the bottom.

China Post Securities pointed out that short-term A-shares will continue to fluctuate and grind to the bottom in the face of mixed environment. The industry configuration recommends the scientific and technological direction represented by electronics, automobiles and medical biology, and can pay attention to bank insurance in the short term. The fundamentals of the domestic economy are improving, but the trend of strong recovery has not yet been determined. We will continue to recommend the science and technology sectors with improved winning rate due to risk preference, mainly including automobiles and electronics related to Huawei’s smart driving concept, as well as medical organisms driven by the development trend of diet pills industry and key products going out to sea. Bank insurance will have a certain comparative advantage in short-term because of the public increase in Huijin’s secondary market and overseas risks. In the medium and long term, it is suggested to pay attention to three main lines. The first category is the target related to the decline in the potential growth rate of macro-economy and the decline in macro-economic capital expenditure, which mainly corresponds to high dividend assets. The second category is the science and technology sector with independent research and development as the main line, such as Huawei’s industrial chain and semiconductor equipment. The third category is the global distribution enterprises deeply involved in the global industrial division of labor, such as consumer electronics, automobiles, medicine and machinery.