It is obvious that Mercedes-Benz’s road to electrification is not smooth. In the process of "elephant turning around", although Mercedes-Benz launched a variety of new energy vehicles, it did not stir up any splash in the market, such as EQC, EQV and other models, which not only made the monthly sales volume bleak, but also accompanied by the huge suspicion of "changing oil to electricity".

Although it came late and got off to a bad start, the new energy market is the future direction of automobile development, and Mercedes-Benz certainly can’t let go of the "new energy track", so in order to get rid of the stereotype of "changing oil into electricity", increase the profit of pure electric vehicles and expand market share, Mercedes-Benz launched a new pure electric platform-EVA.

After that, Mercedes-Benz models were launched around the EVA platform, and EQS, EQS AMG, EQS SUV and Maybach EQS SUV were launched one after another.

However, the development of things did not succeed in Mercedes-Benz’s wish. Due to the high premium of new models and ungrounded conditions, EQS only achieved more than 200 vehicles in the domestic market in the first half of this year, accompanied by the dilemma of price diving, while other models were even more terrible.

Mercedes-benz EQS

Under the above background, Mercedes-Benz launched the domestic version of EQE, which is more affordable to the people, in an attempt to break this dilemma. However, competitors at this price are emerging one after another, such as BMW i4 and Audi A6 E-Tron, and new domestic forces have long been eyeing up. Therefore, it is not easy to regain a city in the new energy track if you want to rely on EQE. Among the three major parts of electric vehicles (driver assistance system related to three electric/intelligent/automatic driving), the performance of Mercedes-Benz EQE is very important.

At present, the automobile industry has entered the era of smart cars, and the most important embodiment of the intelligence of smart cars is the intelligent driving assistance system. At present, automatic driving cannot be realized, but they are all working in this direction. Mercedes-Benz EQE also regards its L2-level assisted driving as a big selling point in the module of "Perception of Technology".

(Information taken from official website)

So what is the strength of Mercedes-Benz EQE in today’s intelligent driving assistance among the three major electric vehicles? Is it worth looking forward to? In this paper, the intelligent driver assistance system of Mercedes-Benz EQE is analyzed in detail as far as possible through the exclusive arrangement of the intelligent driver assistance function, the configuration of major sensors, the topological structure of wiring harness and the realization paths of various functions.

First, the car profile and driver assistance functions are sorted out

At the beginning of this chapter, in order to make it easier for everyone to intuitively understand the current classification and progress of intelligent driving, and to understand the L2 intelligent driving assistance system of Mercedes-Benz EQE, the author combed out the following information on the basis of China’s Auto Driving Automation Classification (GB/T 40429-2021) which came into effect on March 1, 2022, combined with the actual car scenes used in the corresponding grades.

At present, autonomous driving technology is divided into six grades: L0-L5. Among them, L0 class can’t continuously perform the lateral or longitudinal motion control of vehicles in dynamic driving tasks, but it has the ability to detect and respond to some targets and events in dynamic driving tasks. In this stage, the automatic driving system can perceive the environment and provide information or temporarily intervene in vehicle control to assist the driver to drive the vehicle safely.

The L1-class driving automation system can continuously perform the lateral or longitudinal motion control of vehicles in dynamic driving tasks under its design and operation conditions, and has the ability to detect and respond to some targets and events that are suitable for the lateral or longitudinal motion control of vehicles. The driver and the automatic driving system can perform the driving tasks of vehicles at the same time. At this time, the driver is more like a security officer and mainly supervises the driving behavior of the automatic driving system.

L2 level has the functions of ACC, LCC and other level 1 autopilot systems, and it also has the ability to control lateral and vertical motions at the same time. In the autopilot function of L0-L2 level, the driver has the highest control authority and can intervene at any time to immediately release the control of the autopilot system, which is also the level that can be achieved at present.

L3 level means that the system continuously performs all dynamic driving tasks under its design operating conditions, L4 level means that the system continuously performs all dynamic driving tasks and automatically executes the minimum risk strategy under its design operating conditions, and L5 level means that the system continuously performs all dynamic driving tasks and automatically executes the minimum risk strategy under any driving conditions.

With the above basic information, it will be more convenient to understand the intelligent driver assistance system of Mercedes-Benz EQE.

At present, the domestic version of Mercedes-Benz EQE has a total of three vehicle configurations. The price of EQE 350 Pioneer Edition is 528,000 yuan, the price of EQE 350 Deluxe Edition is 546,000 yuan, and the price of EQE 350 Pre-model Special Edition is 585,000 yuan. It is positioned as a medium and large pure electric vehicle with a cruising range of 717km-752km. According to official data, it provides L2 intelligent driving assistance system.

Turning back to the driver’s assistance function of Mercedes-Benz EQE, the author translated and sorted out various intelligent driver’s assistance functions of Mercedes-Benz EQE by reading the information of Mercedes-Benz official website.

(Translated according to Mercedes-Benz official website data)

For car companies, all intelligent functions are usually divided into two categories: driving and parking. First, because the speed of vehicles is different when driving and parking, the research objects, the application of sensors and various algorithms including decision-making algorithms are also different at the technical level. Second, the functional configuration of intelligent driving is the research object, and the corresponding results are more convenient to be matched on different models in a menu manner.

Mercedes-Benz also divides the intelligent driving assistance system into the above two categories, one is the auxiliary function during parking and the other is the auxiliary function during driving.

As can be seen from the information of Mercedes-Benz official website, the version of the driver assistance operating system comes standard with the classic version of the driver assistance component, while the middle-high version comes standard with the enhanced version of the driver assistance component. Functionally, the low version of the active safety early warning system does not have DOW door opening warning, but the middle-high version is standard. In addition, the road traffic signs in the low version are identified as optional, and the middle-high version is standard. In addition, the number of sensors in the low version is one less than the other two, and the difference lies in the number of cameras.

(According to the information of Mercedes-Benz official website)

However, there must be beautification packaging in the wording of the manufacturer, which may lead to our misunderstanding. In order to avoid this situation, the author will show you the essence through the phenomenon through several functions of Mercedes-Benz EQE.

(According to the data of Mercedes-Benz official website)

Second, the sensor composition of EQE intelligent driver assistance system

1. Number of sensors

Mercedes-Benz EQE provides 23 sensors related to the intelligent driving assistance system, including 1 long-distance millimeter-wave radar, 4 corner radars, 12 parking ultrasonic radars, 1 front binocular stereo multi-function camera, 4 360 parking cameras and 1 in-car viewing angle camera, etc., and is equipped with the enhanced version (P20) of the driving assistance module. The intelligent driving assistance function based on the intelligent navigation distance limiting function (ACCA) can achieve L2 automatic driving level.

In terms of sensor configuration, Mercedes-Benz EQE is far less than the current domestic models of the same level. The new HI version of Extreme Fox Alpha S is equipped with 34 sensors, the whole car of Tucki P7 is equipped with 31 autopilot sensors, and the whole car of Weilai ET7 is equipped with 33 sensors. The prices of these models are far less than those of Mercedes-Benz EQE. Therefore, in the era of smart cars, the cost performance of domestic models is still high, while the Mercedes-Benz brand still has a high premium.

In addition, Mercedes-Benz S-Class /EQS/EQE are all a scheme. There is a laser radar in the topology diagram of foreign vehicle controllers, but the domestic version of EQE has been replaced by a millimeter-wave radar instead of a laser radar, which is different from the foreign version.

One of the most obvious advantages of Mercedes-Benz EQE without laser radar is that it will save costs, because the imported Mercedes-Benz EQS, which is also based on EVA pure electric platform, is equipped with a laser radar. It is reasonable to say that EQE can support laser radar, whether it is overseas or domestic. On the other hand, the policies and regulations of different countries and even cities are different. For example, in North America, different states have different requirements for vehicle headlights. Therefore, in order to save trouble, the geometric multi-beam headlights provided by Mercedes-Benz in North America are also castrated, and the domestic version is the full version. However, the next plan of Mercedes-Benz EQE is to drive automatically at L3 level. In the future, if domestic policies allow, the domestic EQE laser radar will also be on the meeting.

2. Sensor layout

The specific layout of the sensor is shown in the following figure:

(Translated according to Mercedes-Benz official website data)

From the layout, one long-distance millimeter-wave radar is located in front of the vehicle, four corner radars are located on the left and right sides of the front and rear of the vehicle respectively, the positions of 12 ultrasonic radars are shown in the yellow icon in the figure, the front binocular stereo multifunctional camera is located on the roof, and four 360 parking cameras are located on two rearview mirrors and the rear half of the vehicle respectively.

Although the car has reached L2 level of intelligent driver assistance system, it is not worth showing off. L2 level is not high enough, and many cars with more than 100,000 can achieve L2.5 level.

3. Sensor brand, technical highlights and corresponding functions

The sensors carried by Mercedes-Benz EQE have been clearly analyzed. Let’s take a look at the advantages and disadvantages of various sensors:

The hardware of Mercedes-Benz EQE intelligent driving sensor basically comes from big factory suppliers.

In terms of millimeter-wave radar, there is generally a "1+4" method for the millimeter-wave radar equipped with intelligent driving in the industry. It is obvious that Mercedes-Benz EQE has also adopted this number with one long-range millimeter-wave radar arranged in front and four medium-short-range radars arranged at the side and rear of the car.

According to the network information, the millimeter-wave radar of China Net comes from the mainland, and the part numbers are A0009000536/A0009009638/A0009006444 respectively. The intelligent driving assistance function involved is the Distinctive Plus, which mainly participates in the professional version of the Distinctive Pro, the collision alarm and so on.

However, according to the data of foreign versions, there is another scheme for this millimeter-wave radar. The supplier is Bosch, and the part number is A0009052017/A0009055518/A0009051019. There are two possibilities, one is to mix them, and the other is to form a difference between the two.

The four corner radars come from Veoneer, a simple understanding of Veoneer, an automobile technology provider located in Stockholm, Sweden. Its products include radar, laser radar, vision system, advanced intelligent driving assistance, automatic driving software, night driving assistance system, active safety sensors, monocular and stereoscopic vision cameras, and it is worth mentioning that Mercedes-Benz is the first to realize L3 in the world.

The parts number of two corner radars on the outside of the front bumper is A0009051516/A0009059517, which cooperates with millimeter-wave radar to participate in the enhanced version of the automatic distance and speed adjustment system and advanced remote parking; The parts numbers of the two corner radars on the outside of the rear bumper are A0009003335/A0009003138 and A0009051416/A0009059417, which have two main functions. One is similar to the two corner radars on the outside of the front bumper, and cooperates with millimeter-wave radar to participate in the enhanced version of the intelligent navigation distance-limiting function system and advanced remote parking, and the other is to participate in the active blind spot auxiliary system.

The supplier of 12 ultrasonic radars is unknown for the time being. In terms of functions, 6 ultrasonic radars on the front bumper and 6 ultrasonic radars on the rear bumper are all active.

Looking at the visual level again, a binocular stereo multi-function camera on the roof of the domestic EQE adopts Veoneer fourth-generation stereo vision camera system, and the part number is A2239006128/A2239006830/A2239006830, which is composed of fully integrated hardware and sensing software. The camera has been upgraded from the third generation to the fourth generation, and the visual field has been expanded from 52 to 100, with improved accuracy and pixels. This camera uses convolutional neural network technology (CNN) to obtain the available space and detect small obstacles, and at the same time, it can accurately classify and locate the objects in front of the vehicle in combination with 3D stereo, which can be applied to most weather conditions. At the same time, thanks to the core algorithm of Mercedes-Benz, the binocular camera can detect the information of the target without classification, and the situation that obstacles cannot be identified can be well solved. At the same time, the stereo binocular can weaken the demand for lidar and reduce the cost.

It mainly participates in intelligent driving assistance functions such as active lane keeping assistance system, automatic high beam switching (IHC), automatic high beam switching, enhanced version (IHC+), traffic sign recognition, speed sign recognition, advanced head-up display (HUD), distance and speed automatic adjustment system enhanced version (DISTRONIC PLUS) and distance and speed automatic adjustment system professional version (DISTRONIC PRO).

The camera in the car comes from LG’s monocular camera, which is mainly involved in the attention assistance system and will give an early warning when necessary.

The supplier of the other four panoramic cameras for the middle net and exterior rearview mirror is Magna, which acts as a 360 camera and plays a great role in automatic parking.

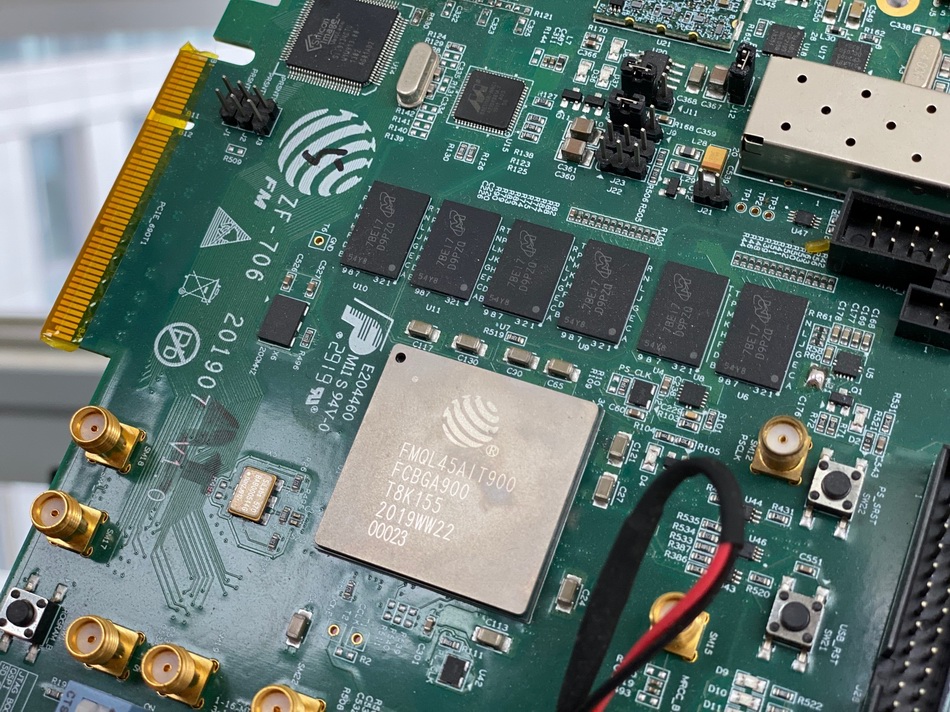

Third, the brain of EQE intelligent driving system: chip

From the analysis of the sensors in the previous article, it can be seen that the number of sensors carried by Mercedes-Benz EQE is not large, so the requirements for computing power are far less than those of domestic new forces.

At present, the autopilot chip used by Mercedes-Benz EQE has not been disclosed, but according to industry speculation, the Mobileye EyeQ4 chip is used in a high probability.

EyeQ Ultra, the latest version of SoC of Mobileye.

Mobileye mainly provides intelligent assisted driving algorithm+chip solutions to meet the demand of L2-level autopilot. As of last year, about 70% of the world’s production cars were equipped with autopilot chips from Mobileye.

The Xavier 8 core chip of Mercedes-Benz NVIDIA that we often hear is not an intelligent driver assistance chip, but its main function is to support intelligent cockpit experience such as MBUX intelligent human-computer interaction system. In addition, this chip is really carried on the overseas version of EQE, and the domestic version of the chip is not clear.

At present, the computing power of Mercedes-Benz EQE’s self-driving chip is unknown. If it is really a Mobileye EyeQ4 chip, then the computing power is likely to be similar to that of Weilai ES8′ s Mobileye EyeQ4 chip, which is about 2.5TOPS.

However, it is worth mentioning that EQE will realize L3-level automatic driving next, and overseas AMG models of EQE have already confirmed that they will have L3-level assisted driving, so the following models should not adopt Mobileye again. As early as 2017, NVIDIA signed a cooperation agreement with Mercedes-Benz, which will provide smart cockpit chips and autopilot chips for Mercedes-Benz. Therefore, Mercedes-Benz EQE will adopt NVIDIA with greater computing power in the future.

Iv. Topology layout analysis of wire harness

If you want to know how to realize the intelligent driving assistance function of a car, you must know the wiring harness layout.

(Topology diagram of Mercedes EQE harness)

Automotive wiring harness is the network subject of automobile circuit, and there is no automobile circuit without wiring harness. In modern cars, there are many automotive wiring harness, and the electronic control system is closely related to the wiring harness.

Generally speaking, if the functions of microcomputer, sensor and actuator are compared with human body, it can be said that microcomputer is equivalent to human brain, sensor is equivalent to sensory organ, and actuator is equivalent to motor organ, then wiring harness is equivalent to nerve and blood vessel.

Previously, the four buses of automobiles were CAN, LIN, FlexRay and MOST. Generally speaking, CAN bus is the backbone, LIN is the deputy of CAN, FlexRay is the hope of the future, and MOST is responsible for cultural undertakings. However, with the increasing demand for intelligent driving in automobiles, high-speed data transmission is required for applications such as navigation system and parking distance control, so LVDS wiring harness is gradually emerging.

1. CAN bus layout of EQE

CAN is the abbreviation of ControllerArea Network, CAN), which is a multi-master bus between nodes for distributed control system. There is no master-slave distinction in data communication, and any node can initiate data to any other node (one or more), with the highest communication rate of 1Mbps. Taking CAN network as the main network can realize the intelligent control of the automobile, such as automatically locking the door at high speed and automatically opening the door when the airbag pops up. CAN is a Bus communication mode, which means that all nodes are connected to the same transmission medium, which means that the electrical signals in the transmission medium will affect all nodes.

From the vehicle controller topology of Mercedes-Benz EQE, we CAN see that Mercedes-Benz EQE still uses CAN as a means of controller networking. There are 20 groups of CAN buses in Mercedes-Benz EQE, which control many functions of EQE body, including steering wheel assembly/system, etc. In addition, it also plays a vital role in EQE’s intelligent driver assistance system.

2. LIN layout of EQE

LIN(Local Interconnect Network) bus is a supplement to other automobile multi-channel networks such as CAN. In general, LIN does not exist independently in automobiles, but is usually connected with other networks such as upper CAN network, which is suitable for applications that do not have too high requirements on network bandwidth, performance or fault-tolerant functions. For example, in Mercedes EQE, it is mainly used for window control, automatic back door, electric rearview mirror adjustment, seat heating and ventilation, etc., and the use of CAN bus for these functions will cause performance waste.

In Mercedes-Benz EQE, there are 40 groups of LIN buses connected to Ethernet, 1 group of LIN buses connected to FlexRay and 28 groups of LIN buses connected to CAN, some of which have the following functions, and are less related to the intelligent driver assistance system.

It is worth mentioning that Mercedes-Benz EQE is equipped with a new generation of MBUX intelligent human-computer interaction system, with a memory bandwidth of 46.4GB/s per second, which is at the leading level in the industry, so the smoothness of the car operating system is guaranteed to some extent.

3. FlexRay layout of EQE

FlexRay is the research and development achievement after CAN and LIN, which can effectively manage multiple safety and comfort functions. The maximum performance limit of CAN network is 1Mbps, and the maximum performance limit of LIN is 125Kbps, while the maximum data rate of FlexRay on two channels CAN reach 10Mbps, and the total data rate can reach 20 Mbps. Therefore, the network bandwidth of FlexRay may be as much as 20 times that of CAN when applied to vehicle networks.

FlexRay CAN run not only as a single channel system like CAN and LIN networks, but also as a dual channel system. Dual-channel systems can transmit data through redundant networks, which is also an important performance of highly reliable systems.

There are a set of FlexRay buses in Mercedes-Benz EQE, which play a vital role in the intelligent driving assistance of Mercedes-Benz EQE. The related FlexRay bus controllers are as follows:

4. LVDS of EQE

LVDS wiring harness is a bridge between the display screen and the communication motherboard, which plays the role of power supply and signal transmission, and the motherboard transmits the picture to the display screen, that is, the screen wire harness. Any running machine with a screen will inevitably have LVDS wires to transmit data.

There are many electromagnetic radiation sources in the automobile, so anti-interference ability is the most basic requirement of automobile electronic design. In addition, considering the low radiation advantage of LVDS transmission line itself, it hardly causes additional interference to other facilities of the system. LVDS transmission only needs simple resistance connection, which simplifies the circuit layout and the line connection is very simple (using twisted copper cable). LVDS is compatible with various bus topologies: point-to-point topology (one transmitter and one receiver); Multi-branch topology (one transmitter, multiple receivers); Multipoint topology (multiple transmitters, multiple receivers).

Mainly for the 360-degree panoramic image system of Mercedes-Benz EQE. The data transmission technology of Mercedes-Benz 360 image system has experienced two technical changes. Early models used LVDS low-voltage differential signal, while the latest models used HSVL high-speed video link. For example, for E-class cars, LVDS technology was used before 2021, and HSVL technology was adopted in 2021.

At present, there is no sign of LVDS wiring harness in EQE’s vehicle controller topology, but it is certain that Mercedes-Benz EQE adopts LVDS wiring harness.

5. Ethernet main bus of EQE

At present, the mainstream view in the mainstream industry thinks that vehicle Ethernet will become the development trend of intelligent networked automobile bus in the future, so this is also the mainstream direction of many automobile enterprises in research.

There are terminal nodes in the network, which simply means that there is only one Ethernet port on a node; And it is simply understood that there are multiple Ethernet ports on a node, and its main function is to forward information. Switch communication means that all terminal nodes can be connected together through switches, and all transmitted information needs to be forwarded by switches. In switched communication, only two ends of a network line are connected to two ports, and there is no bifurcation. So generally we don’t talk about Ethernet bus, but about Ethernet Network.

In Mercedes-Benz EQE, the Ethernet main bus is connected with 40 groups of LINs, and there is also a controller related to the intelligent driver assistance system:

Actual scene analysis, how does EQE intelligent driver assistance system work?

A car’s intelligent driving assistance system involves many levels, besides the sensor level, there are controller, electronic and electrical architecture level, algorithm and so on, which are the three main modules we often say: perception, decision-making and control. Generally speaking, it is similar to people’s eyes, brain and limbs.

The following will analyze how Mercedes-Benz EQE intelligent driver assistance system works from the practical application scenarios of various intelligent driver assistance functions.

1. PARKING (automatic parking)

On the aspect of automatic parking, major car companies are speeding up the mass production of automatic parking. From the perspective of China’s market layout, the concentration of car companies equipped with APA is high, and the top ten car companies account for 84.1% of the market share. The sales volume of Beijing Benz equipped with APA models is far ahead of other car companies.

At present, there are four automatic parking systems, semi-automatic parking (S-APA), automatic parking (F-APA, RPA), memory parking (HPP) and autonomous parking service (AVP).

The automatic parking function of Mercedes EQE is as follows:

(Translated according to Mercedes-Benz official website data)

Mercedes-Benz also explained EQE’s automatic parking system in detail.

(Translated according to Mercedes-Benz official website data)

According to the data of Mercedes-Benz official website, it can be found that the "parking package with 360 camera and remote parking functions" of Mercedes-Benz EQE supports active parking assistance, memory parking and remote parking assistance. In addition, there is a high-precision self-learning map, so the automatic parking system should be located at the highest SAE L4 level in the automatic parking class: Autonomous parking service (AVP).

According to the analysis of Mercedes-Benz EQE sensor, the configuration of the sensor conforms to the definition of autonomous parking service (AVP).

The automatic parking system includes sensing system, central control system, execution system and human-computer interaction system, which are connected by wiring harness. The fourth chapter above involves wiring harness.

From the design point of view, Mercedes-Benz’s parking system also adopts the integrated parking scheme of looking around and ultrasonic, and the whole car does not use lidar. If lidar is used, the problem of sensor perception limitation will be solved on a large scale.

From the perspective of the whole industry, at present, there are many L2 and L2+ automatic parking integration schemes with car-end transformation as the main technical scheme, and the L4 AVP is involved in Mercedes EQE, so it will also involve the construction of high-precision maps, and the map data needs to be updated regularly and in real time.

It is worth mentioning that the supplier of Mercedes-Benz’s high-precision map construction in overseas models is HERE, whose main function is to serve L3 autopilot. At present, Mercedes-Benz DRIVE PILOT autopilot has landed, and the high-precision map carried by EQE is also paving the way for L3 autopilot on EQE.

Mercedes-Benz DRIVE PILOTL3 Class Autopilot Landing

At present, the domestic version of EQE is equipped with NavInfo. As one of the earliest map vendors in China, NavInfo once became an "oligarch", and NavInfo has close ties with national car companies such as Tesla, Daimler, Ford, BMW, Guangzhou Automobile, Great Wall and Weilai.

According to NavInfo’s new public information, it won the order for the autopilot data management service platform for mass-produced vehicles from Daimler Greater China Investment Co., Ltd. last year, and will build and integrate Daimler’s domestic autopilot platform, and be responsible for the data management service of the platform from November 2021 to November 2024, and at the same time provide data processing services for the passenger cars mass-produced by Daimler Group in China from November 2021 to November 2024 through the platform, so the domestic version of EQE.

After the sensors mentioned above collect the vehicle position information and body state information, the sensing system converts them into digital signals, which provides the basis for the next path planning and decision-making.

In the process of signal transmission, it will be transmitted to the central control system through various routes in the previous chapter (Chapter 4). The specific transmission paths are as follows:

CAN bus –CAN S1 front radar controller area network, CAN S2 rear radar controller area network-controller 4 corner radars (B29/11: left front short-range radar (left front NBR), B29/12: right front short-range radar (right front NBR), B29/13: left rear short-range radar (left rear NBR), B29/14:

Ethernet main bus-controller N41/7: self-learning high-precision map (SHPK), N41/8: position determination.

Chassis FlexRay Bus-A40/11: Multifunctional Camera (MFK).

The information collected by the sensing system is processed and analyzed, and the current position of the vehicle, the position of the target and the surrounding environment are obtained. The central controller judges whether there are parking conditions according to these parameters, calculates the optimal path planning, generates corresponding control instructions, and sends the information such as steering torque and angle information needed in the parking process to the relevant actuators in the form of electrical signals through the vehicle network.

The implementation of Mercedes-Benz EQE is

The signal passes through the chassis FlexRay bus –N68: Electric Power Steering (ES)N68/4: Rear Axle Steering System (HAL)N80: Steering Column Module (Steering Column Tube Module (MRM)) and is finally reflected on the wheels.

The LVDS line is unclear.

2. DRIVING (driving)

In this respect, the functions owned by Mercedes-Benz EQE have been elaborated in the first chapter, and several representative functions are selected for analysis.

2, 1 Active Brake Assist (active brake assist)

Active braking assistance reacts to the actual situation. When there is a collision risk, Mercedes-Benz EQE gives a visual and audible warning, and when the driver does not respond, the system will assist braking.

The sensors involved in the perception level mainly include 1 millimeter wave radar and 12 ultrasonic radars.

Similar to PARKING, the signal is formed by the sensing system, and the transmission path is Ethernet main bus -A89: long-range radar (FBR). The transmission harness of ultrasonic radar is not clear for the time being, but it is clear that the signal must have been transmitted to the central control system.

Finally, at the actuator level, the vehicle will be braked, and the signal transmission path is:

Signal-Chassis FlexRay Bus –N68: Electric Power Steering (ES)N68/4: Rear Axle Steering System (HAL)N80: Steering Column Module (Steering Column Tube Module (MRM))- Brake

At the same time, the signal passes through CAN T:CPC harness to N12/2: SOGE to give an audible warning to the owner.

2, 2 Active Lane Keeping Assist system (active lane keeping assist)

During driving, when EQE deviates from the lane pressing line, the steering wheel will vibrate, and when there is an obstacle beside it, the system will sound an alarm, and at the same time, unilateral braking will intervene to assist the vehicle to return to the right position.

Perception system involves binocular camera on the roof, 4 cameras on the car body, millimeter wave radar, 4 angle radars and 12 ultrasonic radars.

Similar to PARKING, four corner mines are also required to collect information, and the information is transmitted by two wire harnesses: CAN S1: front radar controller area network and CAN S2: rear radar controller area network. This path also participates in active blind spot auxiliary system and intelligent navigation distance limiting function.

In addition, there is the signal of the binocular camera on the roof, and the chassis FlexRay bus-A40/11: Multifunctional Camera (MFK). This signal transmission path is also used in the intelligent navigation distance limiting function, speed sign recognition and traffic signal recognition function.

The information transmission path of millimeter-wave radar is similar to that of active braking assistance, so I won’t go into details, and it is also used for intelligent navigation distance limiting function.

At the execution level, the signal is also transmitted through the chassis FlexRay bus, and finally the vehicle sends out an alarm sound, and the system assists the vehicle to return to the right position.

There are many similarities in the transmission paths of active parking assist system, active braking system, active lane keeping assist system and intelligent navigation distance limiting function. The sensors, actuators and transmission paths involved in each function can also be clearly seen in the harness distribution in Chapter 4 above, and the general idea is similar to that of active braking assist system, active lane keeping assist system and automatic parking analyzed above.

The remaining auxiliary functions can also be analyzed according to the above ideas.

In addition, the actual experience of Mercedes-Benz EQE’s intelligent driver assistance system has been evaluated by German ADAC test before, as follows:

Mercedes-Benz EQE has excellent driving stability and insufficient steering accuracy, but fortunately, with the help of intelligent assisted driving, the model can easily keep driving in a straight line; In terms of braking, the brake pedal feels stiff and there is no clear pressure point. German ADAC test thinks that this is a point that Mercedes-Benz needs to improve, otherwise it will permanently interfere with EQE’s driving experience. In terms of active safety assistance system, Mercedes-Benz is in the leading position in the industry, which is also reflected in EQE models. Under the functions of emergency braking system, including collision and distance warning, it can ensure safety to a great extent; Pedestrian protection is equipped with an active hood, which will automatically rise in the event of collision, thus increasing the distance from hard engine parts. In addition, a predictive emergency braking assistant is standard, which can respond to pedestrians and cyclists.

On the whole, Mercedes-Benz EQE’s intelligent driving assistance has a good help in the actual driving process, but it should be noted that the models tested by ADAC are overseas versions, which are of reference to our domestic consumers, but not much.

VI. Summary

In the research and development of intelligent driving technology, Mercedes-Benz should be regarded as an early brand. As early as 30 years ago, based on the European "Eureka" research plan, it launched an intelligent transportation project called "Prometheus". From the end of 1990s to 2005, Mercedes-Benz introduced a distance control system named DISTRONIC and an upgraded version-Distronic Plus.

After 2015, Mercedes-Benz began to explore intelligent driving through travel services, and in 2018, it cooperated with doctors to launch the Robotaxi service of L4/L5 unmanned taxi in California.

In the last five years, there have been frequent actions. In July 2017, Mercedes-Benz invested in Momenta, a self-driving startup in China, and acquired Torc Robotics in April 2019, which significantly accelerated the intelligent strategy.

However, there is still a significant gap between this speed increase and the research and development, popularization and cost control of smart cars in China. Judging from the cost performance and quantity of its intelligent driving system hardware, the new force of making cars in China is basically the existence of this intelligent driving assistance system that can kill EQE, so from the comparison of peers, this system can’t support the price as high as 500,000 yuan.

Judging from the sensors carried by Mercedes-Benz EQE, it is imperative for Mercedes-Benz EQE to use L3 intelligent driver assistance system. If it can get on the road, then the new domestic forces will only increase, so the high premium of Mercedes-Benz will continue to exist to some extent.